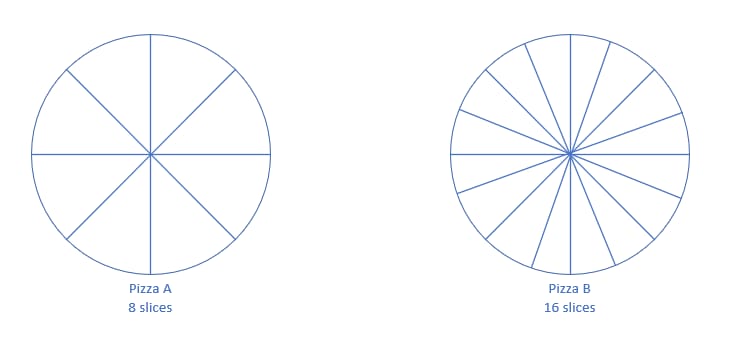

The picture above shows two pizzas, Pizza A and Pizza B. Both are the same size, but Pizza A has 8 slices, while Pizza B has 16 slices. Pizza A can be shared among 8 people, and Pizza B can serve 16 people, though with slightly smaller portions. Which would you prefer: Pizza A or Pizza B?

Now, let’s assume Pizza A represents Company A and Pizza B represents Company B. In this analogy, each slice is like a “share,” officially known as an outstanding share. Company A has 8 outstanding shares, while Company B has 16 outstanding shares. When a company makes a profit, it’s divided by the number of outstanding shares to determine the earnings per share (EPS).

Let’s say both Company A and Company B make the same profit of $80. The EPS for Company A would be $10 ($80 / 8 shares), while the EPS for Company B would be $5 ($80 / 16 shares). In this case, Company A’s earnings per share are higher than Company B’s, making Company A more attractive if we’re focused on per-share earnings.

This example shows that if a company has more outstanding shares (more slices to divide), each share represents a smaller portion of the profit (a smaller slice). So, when evaluating companies for investment, it’s essential to consider the number of outstanding shares. Ideally, we want to see if a company has managed its outstanding shares well over the past 10 years, either keeping them stable or reducing them.

However, a note of caution: some companies may reduce their outstanding shares by taking on debt. This can be risky if not managed carefully, so it’s also essential to consider the company’s debt levels when analyzing outstanding shares.

I hope this clarifies the importance of outstanding shares.

Happy Investing!

You must be logged in to post a comment.